The Red Queen’s Wall: Economic Inequality Through the Looking Class

The Red Queen’s Wall: Economic Inequality Through the Looking Class

How Inequality Compounds, and What we can do About it

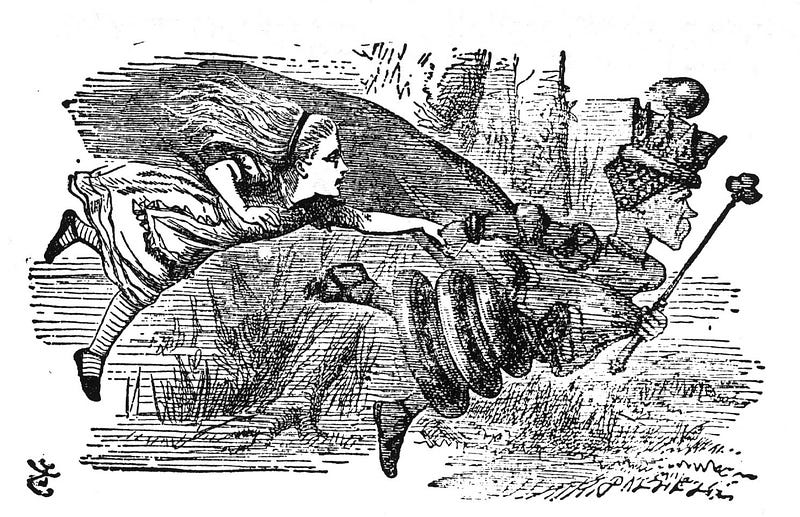

Competitive environments like wild ecosystems and markets, where most of what constitutes the relevant environment for fitness is the behavior of other agents, are often described with the metaphor of the Red Queen’s Race — named after the character in Through the Looking Glass who says “here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

This metaphor is lossy because it does not sufficiently describe power asymmetry.

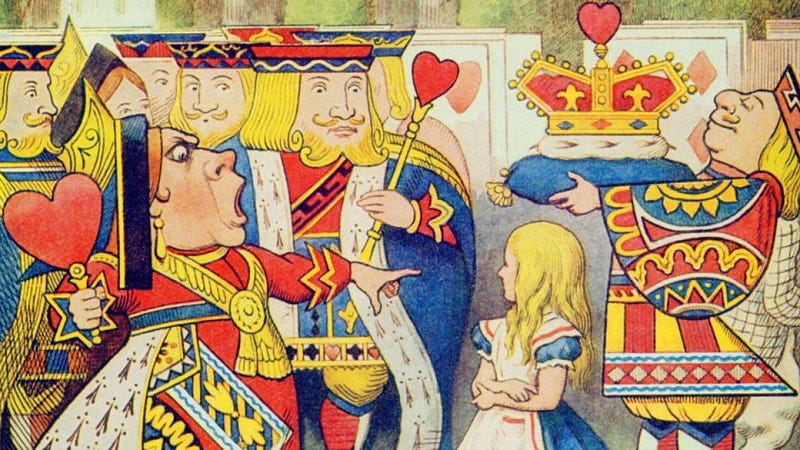

The accumulation of power asymmetry is at the core of what makes environments competitive in this way. Within a single iteration, we may easily justify this asymmetry: successful agents gain power because they have won it by succeeding; this power incentivizes them to try harder; they most successful are also the most worthy of this power because they are the most likely to do something useful with it. However, looking at a larger iterative game, we see a different pattern: power is a results-multiplier, so early successes quickly compound. It’s not that everyone needs to run as fast as they can to stay in place — the Red Queen herself is so far ahead that she can sit on her throne and rest, while everyone else runs as fast as they can only to inevitably fall behind.

Early successes compound even if they are accidental or extremely environment-specific: a short string of good luck produces circumstances under which any action, so long as it’s not a really terrible choice, will usually produce better results than the best possible choice available to a less-powerful person.

Nevertheless, in a rapidly-changing environment, what constitutes a terrible choice is quite variable. If an agent has lucked into power, the most sensible thing to do with that power is to create a buffer against the environment.

The Red Queen, with her head start, builds a wall between herself and the distant second place, giving her more time to rest.

Indeed, this is exactly what the norms and habits of the successful tend to act as: a corporation is a legal entity for preventing capital-owners from liability from their crimes or debts; the manners and trappings of social class are a means of slowing the infiltration of nouveau-riche into high society (functionally forcing them to assimilate); the elaborate self-help regimens of venture capitalists and their exhortations to travel the world are the means by which wannabe tech-bros are drained of their savings and thus defanged. Even interest-bearing loans and property rental are essentially Red Queen’s walls: anyone who bears debt or rents is paying a rich person to be rich on a continuous basis.

The Red Queen’s wall serves a double purpose: it makes it nearly impossible for the already-successful to fail, while simultaneously making it nearly impossible for the not-yet-successful to succeed. The benefits of good decision-making by the non-rich are transferred directly to the rich, and so the further you are from the relatively-mobile mean net worth, the less it benefits you to make good decisions at all. This is not a matter of income inequality but of agency inequality and the allocation of responsibility.

The wall always comes down, to be sure. If you’re not moving, eventually one of those that are will catch up to you. Rent-seeking is an excellent way to change the landscape: you siphon the speed off your lessers, so that the faster they run the further behind they fall, while you speed ahead by staying in place.

But, even rent-seeking is vulnerable to boycott — or others fighting back against the violence inherent in any extraction of rents.

The wall will come down, in the long run.

However, as Keynes says, in the long run we are all dead. In order to be just, must take into account the costs accrued before the utopia arrives — especially since one can never, in good faith, claim its arrival to be totally inevitable.

The rationalist community has a slogan for rational behavior: shut up and multiply — in other words, multiply costs by probabilities and then pick the decision that has the best projected outcome. The problem with this technique is that it tends to create strange artifacts around supposed certainties and impossibilities, in part because human beings are bad at accurately assessing the probabilities of near-certain or near-impossible situations. Feeding these probabilities back into the equation produces even more garbage: folks who are sure that infinitely superhuman AI will be created end up being unable to dismiss Pascal’s Wager-like traps that recommend doing foolish things. Were an endless utopia guaranteed, the infinite happiness it produced would be worth near-infinite suffering; but nothing is truly endless nor can we be absolutely certain about any future event. Shut up and multiply — sure — but beware of infinite terms.

After all, while walled in, the elite can be arbitrarily wasteful. They can destroy others, and they can be self-destructive with the confidence of one who knows he will be saved. They usually cause their own downfall, but the likelihood that any given action (no matter how obviously foolish) would do so is infinitesimal. They play Russian roulette with million-shot revolvers, and the bullets are liable to hit us instead.

A single vast flattening will level the playing field for only one iteration. Without care, new elites will appear. This is attractive only to those who are confident that, in a world with equality of opportunity, they would rise to the top — but luck will once again outflank skill and early winners will build their walls again. Instead, we need to look at voluntary structures for keeping power asymmetry within ranges that can be approximated linearly.

Patchwork systems help a little bit: with a large number of small groups, each group is liable to have roughly similar resources, and any group that begins to defect can be destroyed by a fairly-disorganized temporary coalition of other groups. Patchwork systems that try to enforce a right to exit (like bolo’bolo) are even better: no coalition of de-facto group leaders can easily mobilize their groups without the consent of individuals, and attempts to do so will usually lead to group collapse. Nevertheless, within the economy of a single patch or within the economy of the patchwork itself, accumulation can scale exponentially through a couple of years of canny trade, to the point where catching up is no longer possible. The economy of the patchwork can become distorted toward a pseudo-capitalism merely through stockpiling.

Other, stranger economic policies might help. For instance, an inherently inflationary currency — one that loses value when stockpiled — is a hot potato. Plenty of resources also act this way — food, for instance. If the primary currency for inter-group trade is perishable, resource differences between groups will remain linear despite healthy trade. The least perishable (and most rental-friendly, if you have state-scale enforcers on your side) resource is space, and so even in economies centered around exchange of food, if private land rights are enforced by armies, an aristocracy will be fostered (and indeed, this describes feudalism in Europe and Japan as well as sharecropping in the United States); because of this, inflationary currency is not enough, and must be paired with use-based notions of property (what a Marxian would call personal property rather than private property), strong exit guarantees for land ownership (such as strong squatter’s rights), or strong counterbalances to the economic multiplier of land rental (such as a high Georgist land value tax). Intellectual property is (for the duration of its protection period) highly non-perishable, although the costs of enforcing it are high (it must be proactively enforced everywhere, rather than at the boundaries of territory); where a strong state exists, these costs are eaten by the state and therefore externalized by the ‘owner’, but in a patchwork context large-scale enforcement of IP is not possible & small-scale enforcement cannot provide sufficient returns to counterbalance a perishable trade currency.

In a somewhat more conventional economic context, UBI and sovereign wealth funds (which provide a fixed amount of money to all citizens) help to narrow the gap. The marginal value of money (in terms of power) is inversely proportional to how much someone already has: twenty bucks means more than twice as much to someone living off minimum wage as it does to someone living off double minimum wage. If everyone is provided with the cost of living, then the poorest will suddenly be able to afford to live while the richest won’t even notice their extra income. However, without certain guarantees around land rental, it’s likely that the landlord class will conspire to eat up most of this benefit from the rentier class. Rent freezes can allow the precariat time to gain better footing before exiting the rental ecosystem altogether (though there will be big losers even in this situation, as land prices will probably rise with greater demand). Again, a combination of strong squatter’s rights and a high land-value tax can even things out. This combination has the benefit that it can be proposed & executed within an existing state, easing the transition to fragmentation while providing immediate benefit to folks who are already being screwed.